What Your SAAS P&L Isn’t Doing For You

EXECUTIVE SUMMARY

Your P&L should be built for management insights, not tax compliance

SAAS metrics are a must to properly manage a P&L. These can be implemented in 2 steps (1) a basic ARR build and (2) more complicated metrics like CAC & LTV

If you’re a SAAS or AI founder and you don’t know much about these topics, we’re happy to do a “finance-101-SAAS-P&L” call for free, and don’t worry we’re not trying to sell you on anything, we just genuinely are passionate about these topics.

Many SaaS startups we work with start in the same place: they ask us to build a budget from scratch or evaluate the one they already have. It’s a routine financial task, but it’s also when deeper management information issues come to light.

I typically see 2 big themes at SAAS companies:

#1 P&Ls are built for tax compliance not management insights

One of the biggest themes we see as a Fractional CFO is that the P&L is built for tax compliance, not management visibility. So the first step is often re-bucketing the general ledger (or creating new general ledger categories) so we can clearly categorize the spend of the business.

A simple example to demonstrate this is “meals”. It’s often one category - because for tax purposes all meals are the same. But from a management perspective they couldn’t be more different. So instead, we usually split it into

Internal team meals - which are great for employee perks but generally a place we want to watch the budget and

Sales meals - which we want to encourage our sales team to use as that helps us win new business.

Without splitting these categories we have no visibility in the differences and thus cannot manage them.

#2 SAAS metrics should be tracked as part of the P&L, but usually they sit outside of quickbooks

Probably the more challenging step is building in ARR, churn, & CAC / LTV, and all of the billings-based cashflow differences these drive. It’s challenging because it involves pulling data from Hubspot or Salesforce and combining it with your GL from Quickbooks.

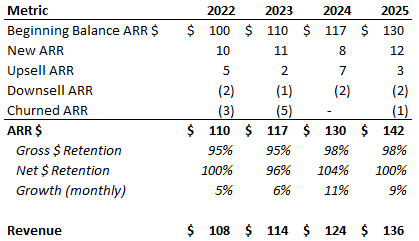

So, first, we go with a barebones approach that will inform us (and investors) how the topline (revenue / ARR) is really performing on a more granular level. It usually looks something like this:

As a second step, we would add in other important metrics like CAC & LTV.

So, if you’re a founder of a SAAS company and some of these metrics seem unfamiliar or you don’t know exactly why we track them or the benefit they offer, feel free to ping us on LinkedIn or our Contact Us - we’re happy to walk you through them.

Summary

How we can help you: We build budgets that serve as operational tools, not just spreadsheets. That means:

Creating flexible models that can be updated quarter to quarter

Structuring budgets around the metrics investors actually care about

Highlighting where resources are misaligned—whether that means underinvesting in sales or overstaffing in R&D (Research & Development

Connecting department inputs to strategy so leaders can track and own outcomes

What It Delivers:

Visibility into real-time runway and cash needs

Objective data for deciding where to scale or cut

Clarity for the board and investors

Strategic discipline across leadership

A reliable baseline for measuring budget vs. actuals moving forward

Budgeting isn’t just a finance function—it’s a leadership discipline. It helps companies uncover blind spots, make smarter trade-offs, and build momentum around the right priorities.

If you're running a SaaS company and don’t have a budgeting process that gives you clarity—let’s change that. Contact Us.